[ SOLUTIONS > BY INDUSTRY > INSURANCE ]

[ BENEFITS ]

The Next Evolution of Insurance Data Operations

Aparavi helps insurers speed up claims, improve underwriting, and maintain audit-ready compliance across distributed data environments.

Accelerate Claims Review

Automatically identify, tag, and route relevant documents for faster, more accurate claims processing.

Enhance Underwriting Efficiency

Clean, classify, and prepare historical and third-party data for use in modern risk models and AI workflows.

Ensure Regulatory Compliance

Automate data handling to meet evolving requirements from NAIC, FINRA, GDPR, and state-level mandates.

Case Study

Manufacturing Chatbot

Building a Chatbot with 9M+ Files

A manufacturing company used both the Data Suite and Toolchain to clean, organize, and pipeline 9TB of data into a working AI assistant in just 5 days.

→ Faster development. Improved response quality. Delivered real value

Fintech + AI Governance

Ensuring Trust, Compliance, and Explainability

A global fintech platform partnered with Aparavi to audit, classify, and prepare data for AI projects—embedding governance and compliance into every step.

→ Protected PII. Created audit trails. Reduced AI risk

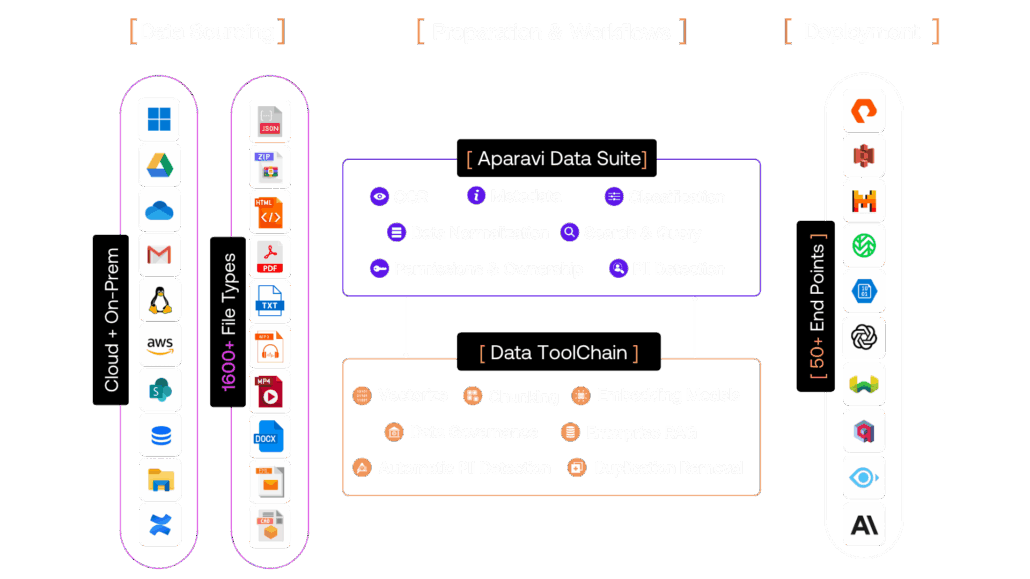

Wherever you are in your AI journey, Aparavi meets you there

[ 1 ]

Data Sources

Discover, index, and visualize data across your environment—for free with Baseline.

[ 2 ]

Prep & Worflows

Classify, clean, dedupe, and contextualize your data for responsible AI use with ADS.

[ 3 ]

Deploy & Action

Build no-code workflows to chunk, embed, vectorize, and route to your LLM with our DTC.

The Outcome: A seamless path from raw unstructured files to trustworthy, explainable AI

Trusted By Lead Organizations

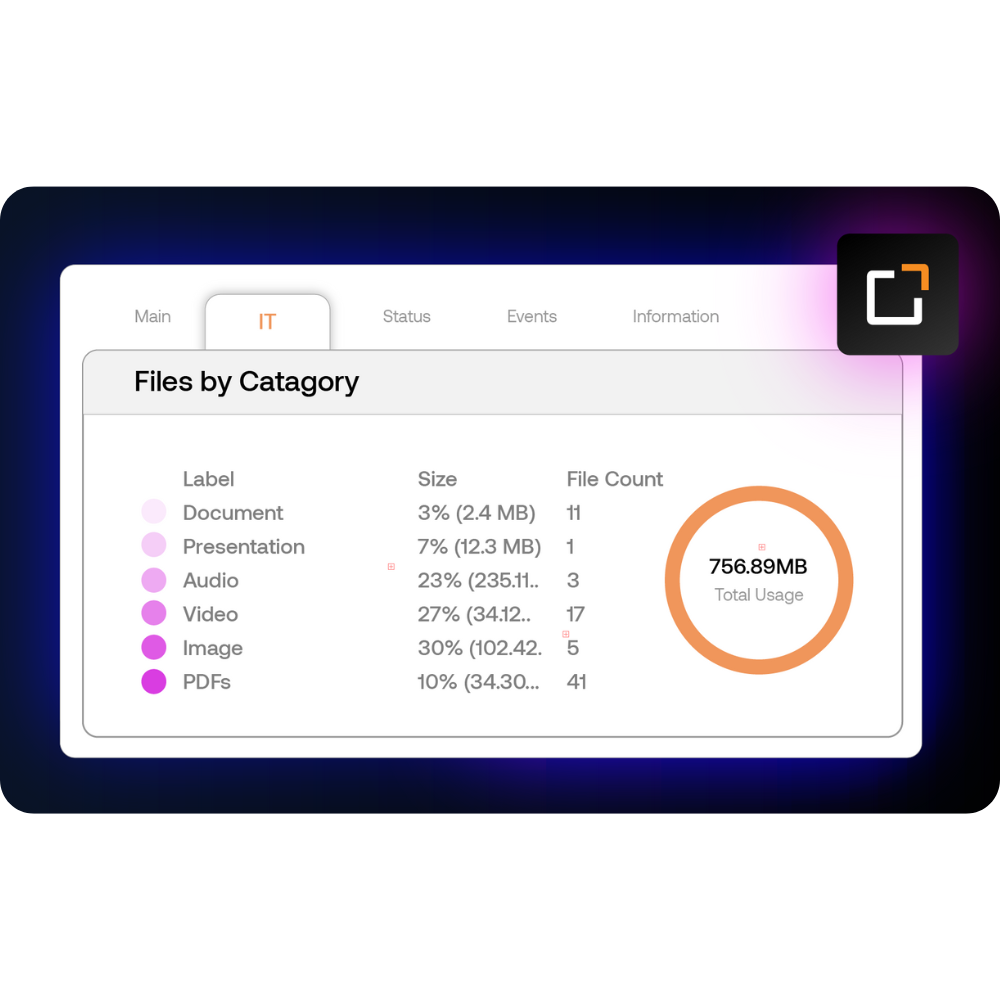

File Types

Faster Data Processing

AI Model Integrations

Petabytes Processed

[ INTEGRATIONS ]

Supports Over 1,600 File Types

Aparavi supports connection to a comprehensive range

of data sources and integrations that are ready to deploy

[ PRODUCTS > DATA TOOLCHAIN FOR AI ]

Build No-code Data Pipelines

→ Turn scattered files into safe, and model-ready datasets

Process 1,600+ file types, detect and redact sensitive info, OCR images, extract tables, create multimodal embeddings, transform unstructured→SQL, and deliver anywhere.

✓ Discover and profile across shares, endpoints, and clouds

✓ Classify PII/PHI/IP and apply policy-based redaction

✓ OCR and advanced table extraction for PDFs and scans

✓ Dedupe, version, enforce governance with full lineage

✓ Chunk, embed (text/image/audio/video), and tune for your content

✓ Deliver to vector stores, warehouses, SQL, and downstream apps

✓ Connectors and REST hooks; schedule incremental updates

✓ BYO models and tools; SDK for custom nodes and connectors

Ship search, RAG, analytics, and automation faster, with trustworthy data, lower risk, and predictable costs.

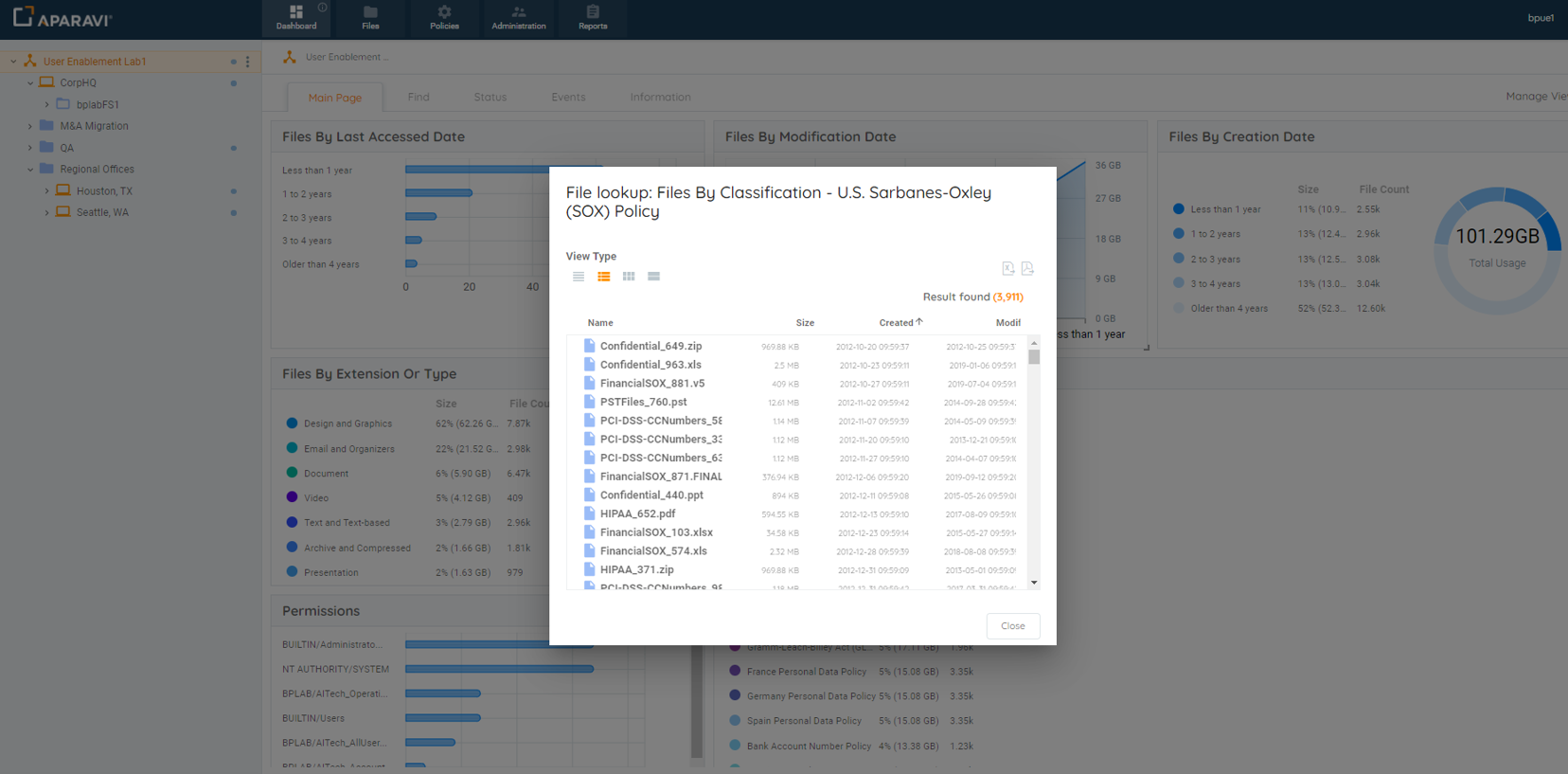

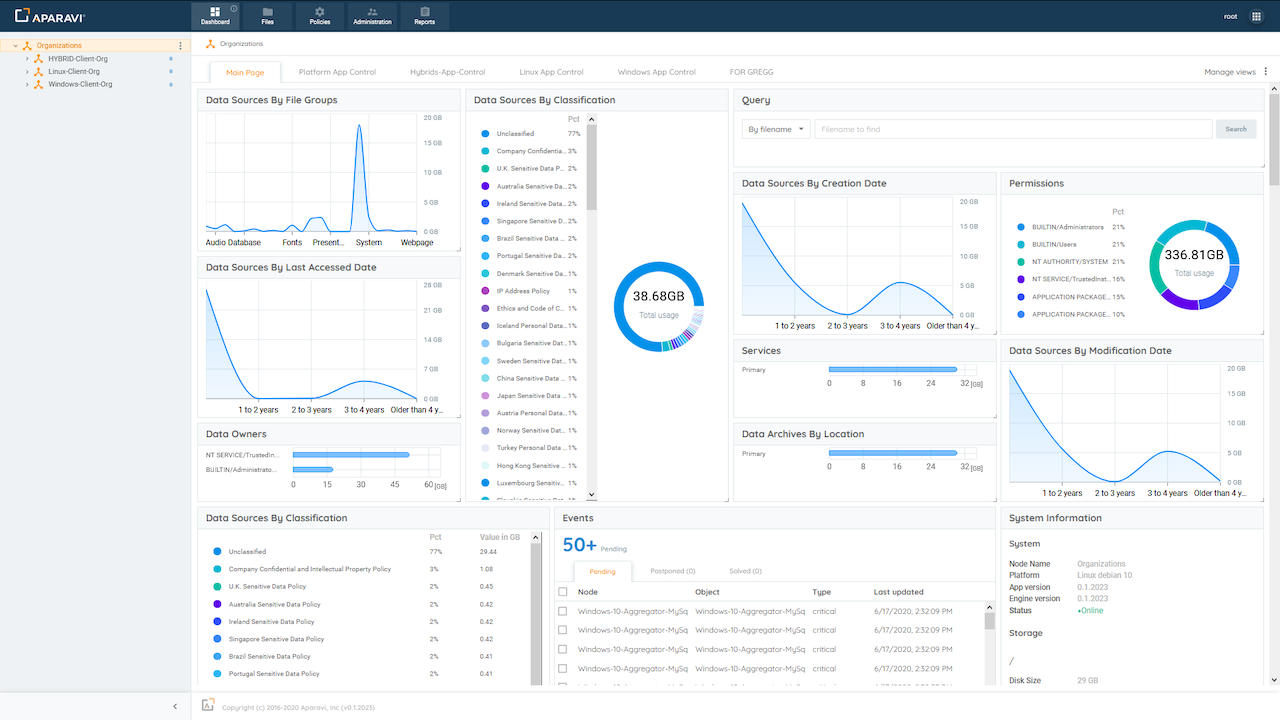

[ PRODUCTS > DATA SUITE ]

Intelligent Data Classification and Tagging

Insurance data includes adjuster notes, policy records, multimedia attachments, and scanned documents. Aparavi ensures:

✓ PII, claims info, and sensitive documents are secured

✓ Duplicates and outdated files are flagged for cleanup

✓ Relevant data is routed to claims systems, risk models, or analytics tools

This enhances response time, improves accuracy, and reduces operational drag.

[ PRODUCTS > DATA SUITE ]

Seamless Integration with Existing Systems

Whether you’re working with core platforms, legacy file shares, or new cloud tools, Aparavi connects without disrupting your processes.

✓ Connects to file servers, email archives, and insurance databases

✓ Prepares data for ingestion into claims management or underwriting systems

✓ Automates tagging, formatting, and handoff

No more manual hand-sorting—just fast, secure access to what matters most.

[ PRODUCTS > DATA SUITE ]

Policy-Driven Governance & Compliance Automation

Data governance is essential for insurers facing high regulatory scrutiny. Aparavi makes it simple and scalable.

✓ Automate retention and disposal schedules

✓ Apply legal holds with precision

✓ Maintain complete visibility and audit readiness

Minimize regulatory risk, avoid fines, and ensure client data is handled with care.

Download this one-pager

Why Aparavi?

We Are The Experts of Unstructured Data

Aparavi puts companies in control of their unstructured data. Our mission is to help organizations discover, classify, and unlock the value of data, reducing risk and cost.

EMPLOYEES

WORLDWIDE

PATENTS

OFFICES

WORLDWIDE

ZUG (CH)

MUNICH (DE)

OHIO (US)

SANTA MONICA (US)

SAN FRANCISCO (US)

Frequently Asked Questions

What is the Data Toolchain for AI, and how does it help my enterprise?

The Data Toolchain for AI simplifies data governance, classification, and compliance at scale. It helps businesses automate workflows, clean and organize data, and prepare it for AI applications, making data management seamless and efficient.

Do I need technical expertise to use this platform?

No, our platform is designed with low-code automation, allowing teams to create AI-driven workflows without needing deep technical expertise. It’s intuitive and accessible for both developers and non-developers.

How does Aparavi ensure data security and compliance?

Aparavi includes built-in security features like PII detection, permissions management, and policy-driven controls to protect sensitive data and ensure compliance with regulations.

What types of data can the platform handle?

The platform supports over 1,000 file types and integrates seamlessly with databases, cloud storage, and on-premises systems, making it easy to find, clean, organize, and prepare enterprise data for AI.

How can I get started with the Data Toolchain for AI?

You can start for free—no credit card required. Simply sign up, connect your data sources, and begin automating workflows to make your data AI-ready.